Do-it-yourself Guide For Handwritten Wills

페이지 정보

본문

Unless you have a complicated estate (several homes, large interest-bearing accounts) a will is likely the most convenient and most economical method to plan for your fatality. If you're seeking a budget friendly choice that features valuable customer assistance, several online estate planning solutions can aid simplify the will- and trust-making procedures. Even with the help of on-line consumer support, moving cash to and from accounts and moving building acts can be tough without lawful help. Therefore, the majority of people who want to develop a trust will need to work with a lawyer.

Does Moving Home To A Count On Secure It From Lenders?

Some select to provide it straight to their assigned Executor, who should then ideally keep it in a fire resistant personal risk-free. If you do not have a Will when you die, it means you have actually died "Intestate." Under these circumstances, individual state legislations will after that determine the distribution of your estate. One of the most expensive path is the standard one, where you meet in person with a legal representative, generally several times, to review and put your strategy into action.

Educating Executors, Guardians, And Recipients

For Stacia instance, a will may specify that a count on be produced to aid care for small kids until they transform 25 years old. You can consist of multiple testamentary trusts in your will, including for philanthropic donations. Assets held in trust fund aren't based on court of probate like wills are. They're additionally most likely to be established with the aid of an estate attorney, which can give them more lawful credibility. This sort of trust fund enables you to change the beneficiaries and possessions as long as you live and literally and emotionally able to do so. If you come to be unable to manage the trust, the trustee you chose can take over for you.

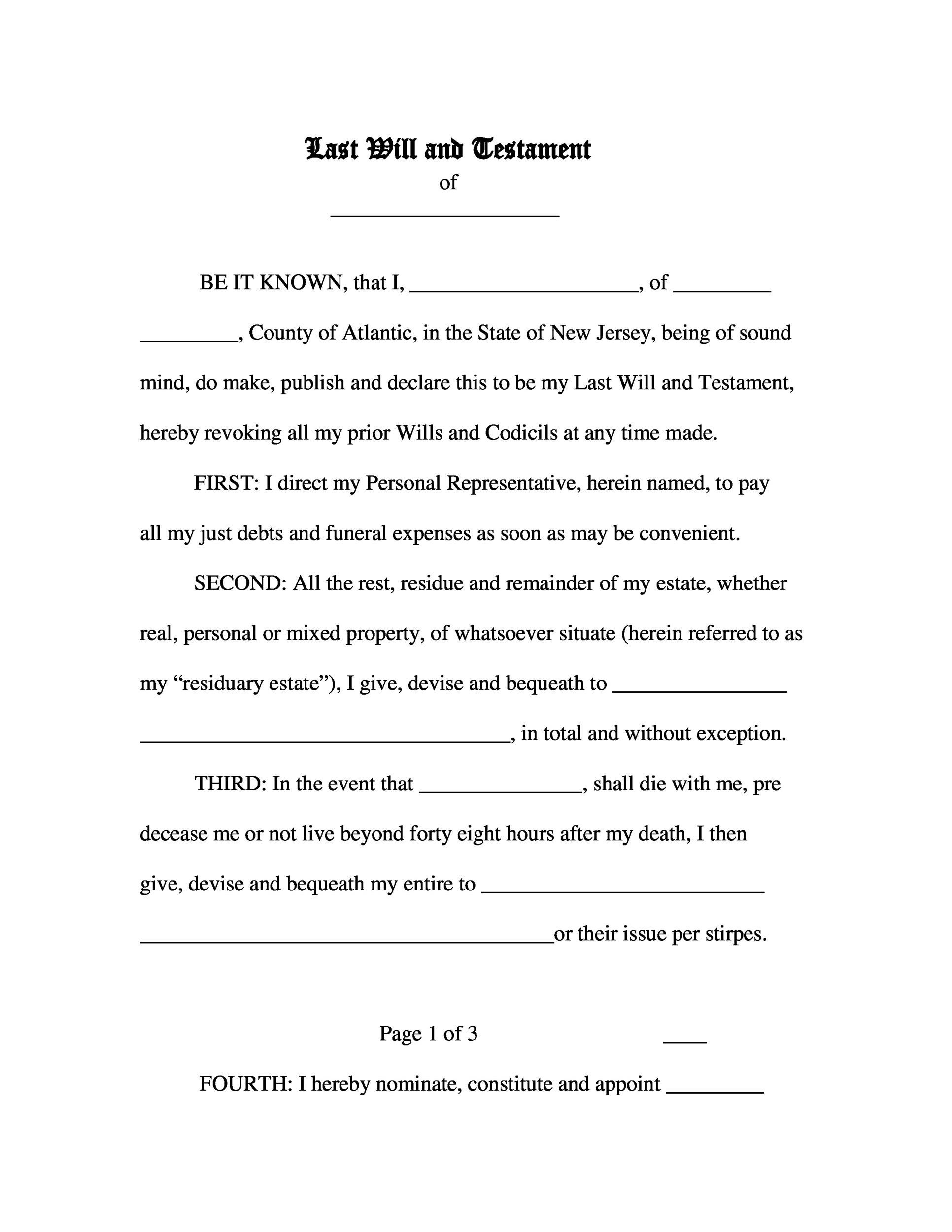

A will certainly allows you to guide how your possessions-- such as bank balances, residential or commercial property, or treasured belongings-- should be distributed. If you have a business or financial investments, your will can define that will obtain those properties and when. The least commonly acknowledged are dental wills, in which the testator talks their wishes prior to witnesses. Doing not have a written record, or a minimum of one prepared by the testator, courts do not commonly recognize dental wills. It's crucial to have both a will and a living will in place to ensure your wishes are performed both in life and after fatality. Planning for the future is not just smart, it's also the only method to regulate your legacy, protect your family, and gain satisfaction.

A will certainly allows you to guide how your possessions-- such as bank balances, residential or commercial property, or treasured belongings-- should be distributed. If you have a business or financial investments, your will can define that will obtain those properties and when. The least commonly acknowledged are dental wills, in which the testator talks their wishes prior to witnesses. Doing not have a written record, or a minimum of one prepared by the testator, courts do not commonly recognize dental wills. It's crucial to have both a will and a living will in place to ensure your wishes are performed both in life and after fatality. Planning for the future is not just smart, it's also the only method to regulate your legacy, protect your family, and gain satisfaction.

While this notarized file may be the simplest method to develop a will, it isn't the most reliable means to accomplish your final desires. It might not also fulfill all the lawful needs neither be legitimately binding. When your will certainly is securely kept, it is essential to notify member of the family, your administrator, guardians, and recipients about it. This includes allowing them know where it's saved, any type of details directions it consists of, and their functions in implementing your will.

While this notarized file may be the simplest method to develop a will, it isn't the most reliable means to accomplish your final desires. It might not also fulfill all the lawful needs neither be legitimately binding. When your will certainly is securely kept, it is essential to notify member of the family, your administrator, guardians, and recipients about it. This includes allowing them know where it's saved, any type of details directions it consists of, and their functions in implementing your will.

What Are The Four Basic Types Of Wills?

When it comes to wills, possessions are taken into consideration either probate or non-probate. Relying on who is still to life, the list proceeds with farther family members-- siblings, grandparents, aunties and uncles, cousins, terrific grandchildren, and terrific nieces and nephews. Should the court determine that you have no living loved ones by blood or marital relationship, the state declares your home. A beneficiary is a person or institution inheriting a piece of your estate, such as cash, physical building, or control of or passion in a business. A healthcare proxy is a long lasting POA especially for medical treatment-- you assign a person to choose on your behalf when you are regarded incapable to do so by a doctor.

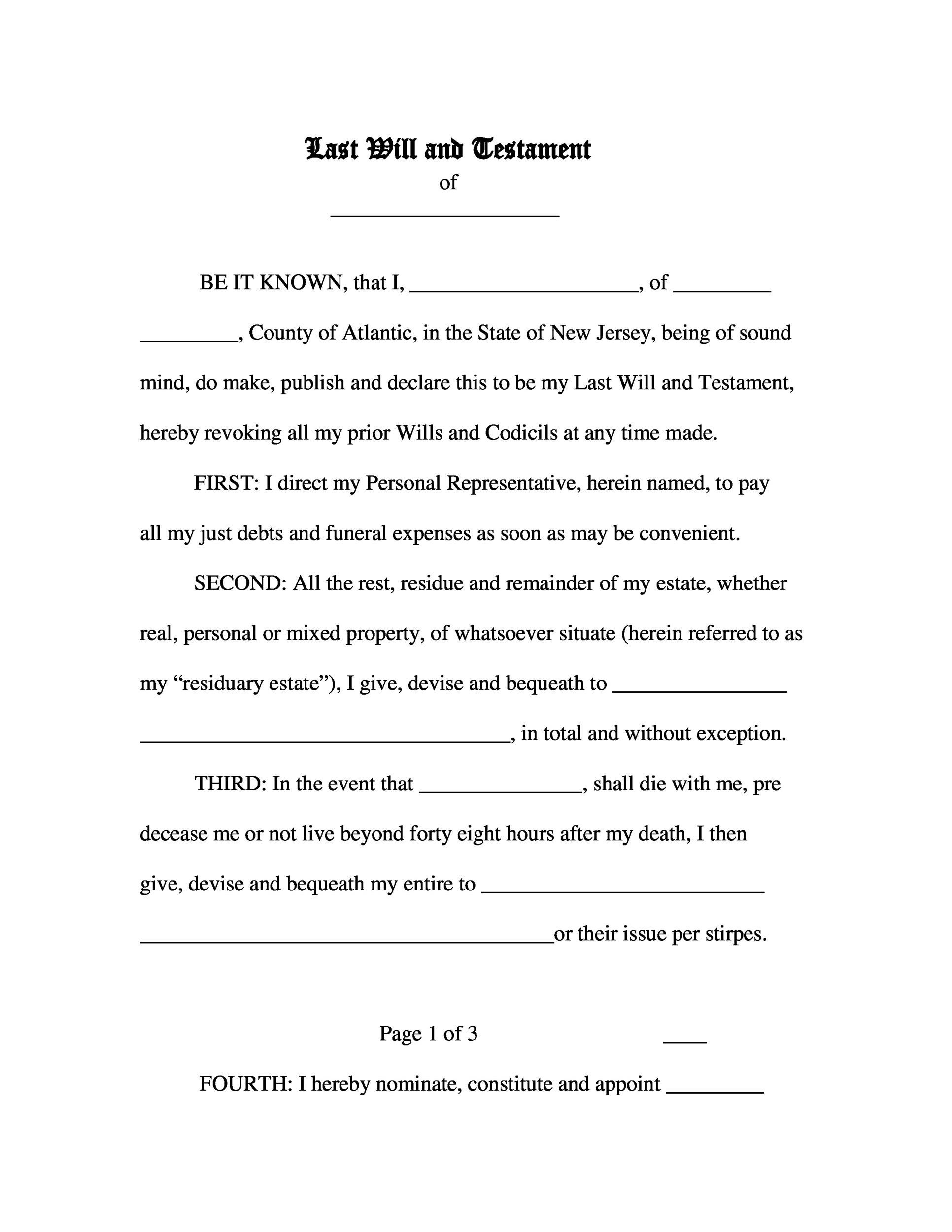

Simple wills: A straightforward will is one of the most common sort of will. It is a straightforward file that allows you to call your beneficiaries and an administrator for your estate. Basic wills are normally made use of by individuals with relatively couple of properties and uncomplicated estate plans.

Where an administrator click here! has used estate funds for their very own benefit or transferred assets to themselves then this called misappropriation of estate/trust residential property. Legal action can be absorbed the civil courts for the administrator to account to the estate for the missing out on money.

If you are seeking to shed even more calories and optimize your weight reduction capacity while working out on a stepper, there are a number of points you can do. Lots of steppers will additionally give manages on the side to aid assistance and stabilize the user. Nevertheless, in comparison to an elliptical exerciser, these handles do not move, therefore do not supply a full-body exercise. A stepper machine (likewise called a stairway stepper or cardio mountain climber), is one more form of health and fitness equipment that can offer a top quality low-impact cardio exercise. If you intend to use your treadmill for cutting weight and burning calories, it is necessary to keep track of your heart rate to see this website to it you aren't straining yourself. While you can burn fat and slim down via various other types of exercising, cardio exercises are the most efficient for reducing weight.

At the time, bond paper was used for developing crucial records, including federal government bonds. Couples can produce trusts to secure revenue for the making it through partner and their beneficiaries after one of them passes away. This way, when one partner passes away or becomes incapacitated, the trust fund proceeds with the various other spouse retaining complete or partial control over it. You name a trustee to manage the properties you are leaving for a disabled individual who might be incapable to manage those possessions on their own. Influence on your credit score may differ, as credit rating are separately identified by credit scores bureaus based on a number of variables including the monetary decisions you make with various other economic services companies.

A philanthropic rest trust (CRT) is an effective estate planning device available to anyone holding valued properties on a reduced basis, such as supplies or real estate. Funding this count on with appreciated properties lets benefactors offer the properties without sustaining capital gains tax obligation. Additionally, charitable remainder counts on are irrevocable, implying they can not be modified or ended without the beneficiary's permission. The grantor successfully removes all of her legal rights of possession to the properties and the count on upon the creation of its irrevocable condition. An irreversible life insurance trust (ILIT) is an essential component of an affluent family members's estate plan. The federal government currently pays for individuals an $11.7 million estate tax exception for the 2021 tax obligation year.

Does Moving Home To A Count On Secure It From Lenders?

Some select to provide it straight to their assigned Executor, who should then ideally keep it in a fire resistant personal risk-free. If you do not have a Will when you die, it means you have actually died "Intestate." Under these circumstances, individual state legislations will after that determine the distribution of your estate. One of the most expensive path is the standard one, where you meet in person with a legal representative, generally several times, to review and put your strategy into action.

Educating Executors, Guardians, And Recipients

For Stacia instance, a will may specify that a count on be produced to aid care for small kids until they transform 25 years old. You can consist of multiple testamentary trusts in your will, including for philanthropic donations. Assets held in trust fund aren't based on court of probate like wills are. They're additionally most likely to be established with the aid of an estate attorney, which can give them more lawful credibility. This sort of trust fund enables you to change the beneficiaries and possessions as long as you live and literally and emotionally able to do so. If you come to be unable to manage the trust, the trustee you chose can take over for you.

A will certainly allows you to guide how your possessions-- such as bank balances, residential or commercial property, or treasured belongings-- should be distributed. If you have a business or financial investments, your will can define that will obtain those properties and when. The least commonly acknowledged are dental wills, in which the testator talks their wishes prior to witnesses. Doing not have a written record, or a minimum of one prepared by the testator, courts do not commonly recognize dental wills. It's crucial to have both a will and a living will in place to ensure your wishes are performed both in life and after fatality. Planning for the future is not just smart, it's also the only method to regulate your legacy, protect your family, and gain satisfaction.

A will certainly allows you to guide how your possessions-- such as bank balances, residential or commercial property, or treasured belongings-- should be distributed. If you have a business or financial investments, your will can define that will obtain those properties and when. The least commonly acknowledged are dental wills, in which the testator talks their wishes prior to witnesses. Doing not have a written record, or a minimum of one prepared by the testator, courts do not commonly recognize dental wills. It's crucial to have both a will and a living will in place to ensure your wishes are performed both in life and after fatality. Planning for the future is not just smart, it's also the only method to regulate your legacy, protect your family, and gain satisfaction. While this notarized file may be the simplest method to develop a will, it isn't the most reliable means to accomplish your final desires. It might not also fulfill all the lawful needs neither be legitimately binding. When your will certainly is securely kept, it is essential to notify member of the family, your administrator, guardians, and recipients about it. This includes allowing them know where it's saved, any type of details directions it consists of, and their functions in implementing your will.

While this notarized file may be the simplest method to develop a will, it isn't the most reliable means to accomplish your final desires. It might not also fulfill all the lawful needs neither be legitimately binding. When your will certainly is securely kept, it is essential to notify member of the family, your administrator, guardians, and recipients about it. This includes allowing them know where it's saved, any type of details directions it consists of, and their functions in implementing your will.What Are The Four Basic Types Of Wills?

When it comes to wills, possessions are taken into consideration either probate or non-probate. Relying on who is still to life, the list proceeds with farther family members-- siblings, grandparents, aunties and uncles, cousins, terrific grandchildren, and terrific nieces and nephews. Should the court determine that you have no living loved ones by blood or marital relationship, the state declares your home. A beneficiary is a person or institution inheriting a piece of your estate, such as cash, physical building, or control of or passion in a business. A healthcare proxy is a long lasting POA especially for medical treatment-- you assign a person to choose on your behalf when you are regarded incapable to do so by a doctor.

Simple wills: A straightforward will is one of the most common sort of will. It is a straightforward file that allows you to call your beneficiaries and an administrator for your estate. Basic wills are normally made use of by individuals with relatively couple of properties and uncomplicated estate plans.

Where an administrator click here! has used estate funds for their very own benefit or transferred assets to themselves then this called misappropriation of estate/trust residential property. Legal action can be absorbed the civil courts for the administrator to account to the estate for the missing out on money.

If you are seeking to shed even more calories and optimize your weight reduction capacity while working out on a stepper, there are a number of points you can do. Lots of steppers will additionally give manages on the side to aid assistance and stabilize the user. Nevertheless, in comparison to an elliptical exerciser, these handles do not move, therefore do not supply a full-body exercise. A stepper machine (likewise called a stairway stepper or cardio mountain climber), is one more form of health and fitness equipment that can offer a top quality low-impact cardio exercise. If you intend to use your treadmill for cutting weight and burning calories, it is necessary to keep track of your heart rate to see this website to it you aren't straining yourself. While you can burn fat and slim down via various other types of exercising, cardio exercises are the most efficient for reducing weight.

At the time, bond paper was used for developing crucial records, including federal government bonds. Couples can produce trusts to secure revenue for the making it through partner and their beneficiaries after one of them passes away. This way, when one partner passes away or becomes incapacitated, the trust fund proceeds with the various other spouse retaining complete or partial control over it. You name a trustee to manage the properties you are leaving for a disabled individual who might be incapable to manage those possessions on their own. Influence on your credit score may differ, as credit rating are separately identified by credit scores bureaus based on a number of variables including the monetary decisions you make with various other economic services companies.

A philanthropic rest trust (CRT) is an effective estate planning device available to anyone holding valued properties on a reduced basis, such as supplies or real estate. Funding this count on with appreciated properties lets benefactors offer the properties without sustaining capital gains tax obligation. Additionally, charitable remainder counts on are irrevocable, implying they can not be modified or ended without the beneficiary's permission. The grantor successfully removes all of her legal rights of possession to the properties and the count on upon the creation of its irrevocable condition. An irreversible life insurance trust (ILIT) is an essential component of an affluent family members's estate plan. The federal government currently pays for individuals an $11.7 million estate tax exception for the 2021 tax obligation year.

- 이전글L'Épine de Lenoir : Traitements et Conseils par Soulager la Douleur 25.05.05

- 다음글Возврат потерь в казино {Стейк казино официальный сайт}: получи 30% страховки от проигрыша 25.05.05

댓글목록

등록된 댓글이 없습니다.